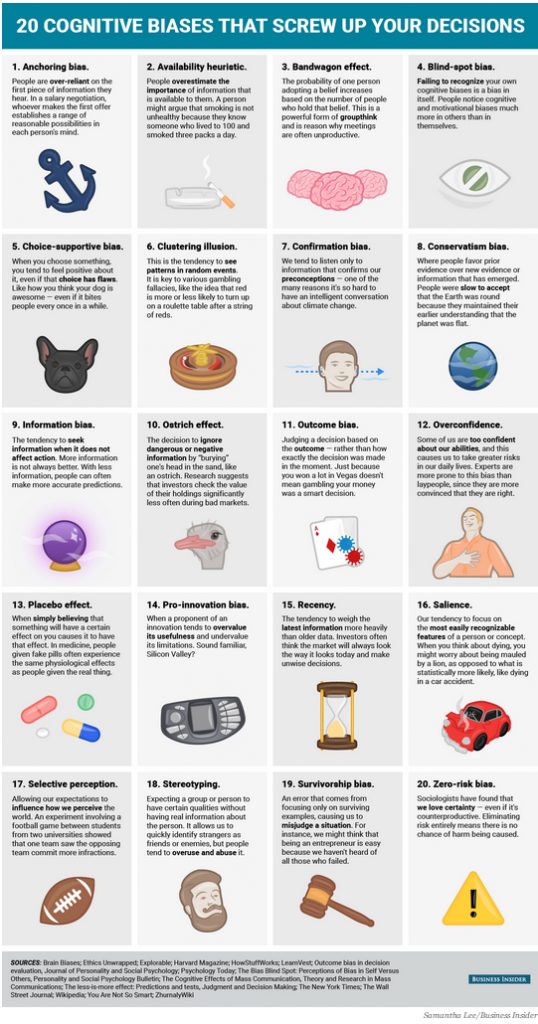

From the things we say to the actions we take each day, our world- and that of business- is comprised of thousands of decisions, both big and small. How we come to make those decisions is the result of intuition and analysis and, in most cases, influenced by biases that we may or may not be aware of.

We know about blind spots in decision making, mostly because of the work of ES collaborators Max Bazerman and Ann Tenbrunsel. A recent graph published in Business Insider: Australia, and included below, depicts additional biases that all would be wise to learn and attempt to obviate when analyzing ideas and programs.

While Microsoft, Walmart and Volkswagen have different operating and governance systems, they are alike in one key way: each is only as good as the people who run them. As we have seen, some run more ethically than others and people can let a variety of conscious and unconscious biases negatively affect their decisions.

Learning more about bias helps us recognize when we are being led down a path that may run counter to the most ethical course of action. The above chart will help identify how to make rational and ethical decision making easier, leading to greater organizational productivity, collaboration and long-term success.

By: Jeremy Willinger, October 15, 2015.

This article was used by kind permission of Ethicalsystems.org.